With thousands of stocks and ETF’s available to trade how do you know which ones to look at? Does it seem like there is a new hot name every day you turn on CNBC or Bloomberg? It drives me crazy when I see people chasing the big name in the news on a daily basis because it can often times lead to disaster. In almost any other business out there people specialize in one area. Does McDonalds serve mexican food? Thank goodness the answer to that one is no! I love Mexican food and the thought of McDonalds ruining that for me gives me the chills. The point here is you need to know the products that you trade as it will give you an edge. I’m not talking about an edge from insider information or a secret indicator telling which direction it is going in. I’m talking about getting to know the characteristics of each product on your watch list. Like it or not, each stock or ETF has it’s own unique personality. I find that by tracking volume with the help of a great software and volatility numbers along with average holding time of a trade really increases my overall confidence level in trading those products. With that in mind, what do I feel are the best names to look at heading into the rest of 2015? Let’s take a look…

I teach my students to evaluate their watch list of products once a month. This allows them to react to changing market conditions without reinventing the wheel on a daily basis. In many cases, we don’t make many changes from month to month. On my personal watch list, I trade some of the same names now that I did years ago. What I’m looking for when making adjustments to my watch list? I’m trying to evaluate the market to see where the movement is at. Is one specific sector starting to heat up or cool down? Are we seeing big moves in certain names or really choppy movement in others? These are questions that can help guide you along the way.

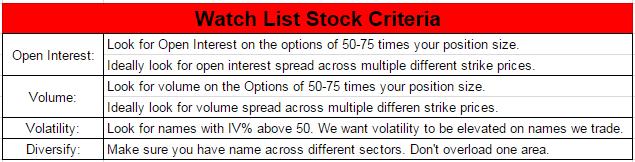

Some of the criteria that I look for when picking the best names to watch are very simple. I have outlined some of the criteria below. With that in mind let’s walk through some of the names that I really like heading into the end of the year.

Names to watch for Fall/Winter 2015:

- SPY – The S&P 500 ETF remains one of the most liquid products in the world. The massive volume in the stock and the options make this an easy one to trade. The Implied Volatility has also increased in the past few months which really opens up our options playbook giving us endless trade opportunities to consider.

- QQQ – While not as liquid as SPY, the Nasdaq ETF has plenty of volume for us to work with. It’s an easy way to diversify as many of the big tech names are reflected in this product, learn how you can start being effective as a freelancer. I like this one for pure directional plays as well as for short premium plays (selling spreads).

- TLT – With everyone’s focus on the Fed these days, I want to have exposure in names that will be active with anything the Fed throws our way. The bond market is an area that can make big moves with anything a Fed speaker says. As a result, having access to a bond ETF like TLT is a great option. TLT is liquid enough for us to do anything that we want with either basic or advanced options strategies. Implied Volatility has also increased in the past few months giving us more flexibility.

- AAPL – Apple is still one of the most popular stocks to trade for day traders and swing traders alike. It is a very liquid product, with both the shares of stock and the options very active on a daily basis. I like trading it because it doesn’t like to stay quiet for long. It is also an easy name to see defined ranges in. While I love the products that Apple produces I like it as a trading product even more.

- NFLX – Netflix has been a really fun stock to trade the last 6 months. It did have a stock split early in the year which I was worried would ruin the way it traded. Many investors have started looking for the next big thing in technology. There are services designed specifically for uncovering the hottest new tech stocks. You can get augmented reality stock picks, social media stock picks, and more. Now, it continues to make really great swings back and forth. When it’s not moving, the Implied Volatility is high enough to sell premium making it one of my favorite products to look at these days. The stock split has also made it more accessible for retail traders to look at. The options are reasonably priced and have decent liquidity, making it a top candidate for the rest of 2015.

- C and GS – The financial sector is another area that can be very sensitive to Fed speak. Regardless of experience or account size you will want to have some exposure with this sector. I like Citigroup and Goldman Sachs for my personal account. They are names that tend to lead the sector both higher and lower and have reasonably priced options as well. The options have decent liquidity, which means we can trade many different strategies with both of these and get filled at good prices. As long as interest rates remain the center of attention, make sure you have a handful of financial names on your list. Others to consider: XLF, BAC, JPM, FAS.

- XLE and USO – The price of oil has been all over the place for most of this year and I don’t see that changing anytime soon. Both XLE and USO are energy ETF’s that we have had nice success with in the Options Mastery program. I like the liquidity in the options and I like how each one does something different for us. XLE is the slower one of the two and it typically does a better job of getting through the volatile moves back and forth better. USO is directly correlated with the price of the Crude Oil futures market, which means it’s a more aggressive way to play directional moves. Both products are liquid enough to do just about any options strategy that you can think of.

- EWZ, EEM, FXI – All three of these are global ETF’s which we have had nice success with. EWZ is the ETF tracking the Brazil markets. EEM is the ETF that tracks the emerging markets. FXI is the ETF that tracks the Chinese markets. Much of the volatility that we have seen in the U.S. this year can also be tracked to the movement in the global markets. I like having products that allow us to participate in that movement without being overly exposed to one individual stock. You have to be careful with these names as they do tend to see overnight gaps for us in the U.S. A good number of the moves happen during the overnight hours so you have to be disciplined to not chase trades that have moved without you. The liquidity in these names also tends the be streaky. Over the last few months it hasn’t been an issue, but if markets start to settle down in the coming months you will want to watch volumes closely. If they start to go down we will want to potentially reconsider some of these names.

- AMZN – Amazon has been a streaky product for us the last few years. When it’s on there aren’t many products out there that will outperform AMZN. However, when this stock settles into a range it can get ugly quickly. The liquidity in the AMZN options also needs to be watched closely. I haven’t had an issue getting filled on my trades at good prices the last few months but if volume does dry up in the coming months we are willing to put this one back on the sidelines. It is a $500 stock so the options aren’t cheap, but I have had really nice success trading vertical spreads on AMZN which is a good way to lower the cost.

- GOOGL – I know Google is another expensive stock, but I have found that it likes to make really nice tradeable moves back and forth on a regular basis. This is another product that I like to use vertical spreads on to lower the cost of the trades. However, it is also another one that you have to be picky where you get in and out of trades at. The bid/ask spread can widen out quickly on the GOOGL options, so make sure you do your best to get filled at or near the mid price.

- AAL, BA, DAL – The airlines have been a new area to my watch list this year. I like any of these 3 names but I personally trade AAL and BA. I don’t always trade these names directionally though. For newer options traders, what I’m talking about here is that I like to sell premium on these 3 whenever possible. Selling spreads is a great way to get exposure to some of these names without placing a big directional bet. With energy prices all over the place, along with the health of the consumer in doubt, I think the airlines could be a good play for the coming months.

- GLD – Gold and silver tend to be names that get more active as more doubt starts to creep back into the market. When fear jumps, there are many traders that start looking at the metals for safety. I like GLD over SLV in my own trading as GLD tends to be more liquid and easier to trade. If we continue to see volatility at elevated levels, look for Gold and Silver to remain active. Here you can read more facts about gold at Raremetalblog.

- FXE – With global currencies in focus these days I also want to have some exposure there. FXE is an ETF that tracks the Euro. It’s not the most liquid product that I have ever traded, but as long as we see the global currency wars front and center I want to be able to profit from some of these moves. The implied volatility on the options of FXE has also been at levels where we have had good success selling premium by using strategies like Iron Condors. I hope to continue that trend over the coming months.

These are some areas that I really like heading into the end of 2015. I’m not saying these are the only names to look at or that you should trade every one of these. However, taking what the market is giving us right now, these are the areas I feel give us the best opportunities to make money. If you want some other areas to look at the argument could be made to have exposure to more retail/consumer related names or even the social media names. Just remember what we have talked about in earlier posts. A bigger watch list doesn’t mean bigger profits. Create a list of names that is diversified, but is also small enough where you can get in and out each day without spending hours looking at the charts. All of the names listed above are active enough to where we can have multiple types of trades on for each name if we wanted to.

The markets are highly active right now and it is a prime time to make money. We have to make sure we are ready to take advantage of the movement and now you have some of my favorite names to look at. We trade these every day in the Options Master program and will continue to do so in the coming months. Now that the watch list is in place it’s time to start getting active in these markets.