For most, the answer to this question is the dreaded choppy

market. It could be the slow choppy market like we see during

the summer months when many markets just sit in a tight

range.

Or it could also be the wild choppy market where we

see big moves back and forth with no follow through in either

direction. Regardless of which type of choppiness we are

seeing, these stretches can cause major headaches for traders

trying to generate profits on a consistent basis. Fortunately, if you take a look at IronFX reviews for options traders there are trade types that actually thrive in

these choppy conditions.

Free Options Mastery System

One of those trade types is called an Iron Condor. While the

name might sound complicated, the trade is actually really

simple to put on. The first thing you have to do when looking

at an Iron Condor is to take yourself out of that mindset of

picking whether the stock is going to make a big move up or

down.

For many traders, this is a new way of thinking because

we are all taught to try and find the stocks that we think are

going to make big moves.

Instead, with an Iron Condor we are going to try and create a

profit window that we need the stock to stay inside. The stock could go up,

down, or sideways and we can still make money as long as it stays inside of our

window.

The Iron Condor’s profit window is setup by selling an out

of the money call spread and an out of the money put spread

at the same time. By selling these two spreads we are trying

to box the price into that profit window. While this might

seem complex and risky it is actually a fully hedged position

meaning we know what our maximum loss could be if the

trade moves against us.

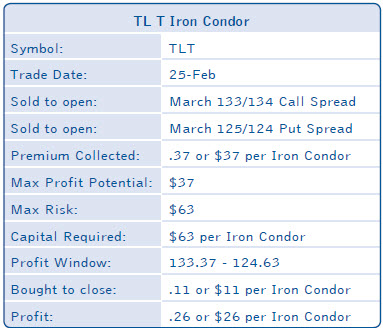

So let’s walk through an example to show how this trade is

setup from start to finish. This is an actual trade that was taken

in our Options Mastery training room. Back in late February

we were looking at TLT which is an ETF that tracks the bond

market. In looking at the chart, we took the opinion that TLT

had already made big moves both higher and lower over the

last few months and there was a good chance that we might

settle into a choppy stretch.

So we started to look at creating a trade that would allow

us to profit from that choppy stretch.

When setting up the Iron Condor, we knew we had to sell

an out of the money call spread and an out of the money

put spread at the same time. When we sell these spreads we

are actually collecting premium to put the trade on. That

premium that we are collecting for placing the trade is the

maximum profit potential.

In our February trade we decided to sell the March 133/134 call

spread and the March 125/124put spread at the same time.

For the call spread we were selling

the 133 strike call and also buying the 134 strike call to hedge

it. On the put spread we were selling the 125 strike put and

also buying 124 strike put to hedge it. Notice on both spreads

the difference between the strike prices is $1.

Our goal on these types of trades is to collect as close to 40% of the width

of the strikes as possible. So in this case we were looking to

collect around .40 when putting this trade on. We actually

collected .37 when placing this trade so we came very close to

the ideal .40 that we were looking for.

The 37 that we collected for placing this trade represents

our maximum profit potential. Remember options represent

100 shares of stock so our maximum profit on this trade

is $37 per spread. While this might not seem like a lot of

money the capital required to make this trade is only $63 per

Iron Condor (the difference between the strikes minus the

premium collected).

Earlier we mentioned that an Iron Condor is a trade that

creates a profit window which we need the stock to stay inside.

So what does the profit window look like on the TLT trade?

First we start with the strike prices of the options that we sold.

In our example this is the 133 call and the 125 put. We

take these strikes and also factor in the .37 that we collected

for putting the trade on. We add the .37 to the strike price

of the call option to get 133.37 and we subtract the .37 from

the strike price of the put option to get 124.63.

These two numbers (133.37 and 124.63) represent the break even points

of the Iron Condor. Or in other words, they represent the

boundaries of our profit window. In order to make money

on this trade all we need TLT to do is stay between 133.37

and 124.63. TLT could move up, down, or sideways it doesn’t

matter to us. We just need it to stay inside of the window. You

can see this demonstrated on the chart below.

So we could put this trade on 10 times

and still have only $630 of capital at use. The $63 capital

requirement to put this trade on also represents our maximum

loss if this trade moves against us.

One of the big obstacles that options traders face is time

decay. Time decay is the amount of money you pay to own

the option each day. When you buy an option the time decay

is working against you. In our Iron Condor example, we are

selling this position to open the trade. So in this case the time

decay is actually working for us. We are making money each

day the stock stays inside of our profit window.

We can also make money on this trade if the stock moves up, down, or

sideways meaning there isn’t the pressure there on us to pick

market direction. Finally because we sold this position to

open the trade, in order to close it we have to buy it back.

The goal is to buy it back cheaper than we sold it for so we

can pocket the difference. The perfect scenario for us is to get

TLT to stay inside of our profit window and then profit from

the options getting cheaper through time decay and also a

potential decrease in volatility.

The great part about this trade is that we are giving ourselves

so many ways of being profitable. We don’t have to decide of

TLT is going to go up or down. So like we just covered, we

could actually be completely wrong on market direction and

still make money. Not a bad scenario to be in.

In our example TLT we were actually wrong on our assumption

that it was going into a choppy stretch. After placing this

trade, TLT continue to make big moves. It originally made a

move lower and then higher as you can see on the chart.

So it didn’t get choppy but we did stay inside of our profit window

so we were able to close the trade out for .11 and book the $26

profit per spread. That’s close to a 70% return in just a few

weeks and the stock didn’t even match up with our original

assumption. Not a bad way to get paid.

The key to successful trading is to be involved with markets

and products that give you the flexibility to make money in all

types of market conditions. Over the past 13 years of trading

I have learned that markets don’t always move for us. Those

choppy stretches will come at some point.

The neat part about options trading is that you can still make money during

these stretches. Profiting from choppy sideways markets isn’t

a problem when trading options and that’s not something

you can say about any other product. Take the time to learn

strategies like the Iron Condor so you can continue to grow

your account when we get into those nasty choppy markets.