With high speed internet access and virtual brokers, many people have taken to online trading in droves. Given that trading, when done right, can give you a lifestyle outside of the rat race, it is no wonder the popularity of trading exploded.

You should have an idea of the mechanics of online trading especially when everything you do will be done online. This article is going to assume you have a trading method that works and you are almost ready to go live in the markets. If you are just starting out, head over to Premier Trader University and get started on the right food.

Online Trading Brokers

A broker is the company that will handle your buy/sell orders for your chosen instrument. Think of them as the “middleman” between your orders and the market where your order is filled.

Important: The mechanics of retail Forex brokers are much different as your order is not filled on the open market. The broker for the majority of retail transactions fills your buy/sell orders/

There is a wide variety of trading brokers available depending on:

- Account minimums

- Leverage required

- Commission levels

- Regulatory body

- Asset class you wish to trade

One of the important things you want to ensure is your broker is covered with one of the many regulatory bodies such as FINRA, FCA, and IIROC.

You will also have to decide on the type of account you wish to open:

- Margin account. You borrow money from your broker against the securities held in your account. This is very popular in the Forex market

- Cash account. Where you use only the cash in your account to purchase the instrument of choice

- Options account. If options are your game, this is where you would park your funds.

It is safe to say that many traders will use a margin account for their trading. You should fully understand the pitfalls of online trading with a margin account.

There are the usual fees such as commissions which can vary between brokers. You can shop around in regards to commission depending on how active a trader you are. Remember, this is how the broker gets paid: commissions on your trades.

There are also hidden fees that they will charge so ensure you read the fine print of the agreement you will be required to sign. Some fees to look for are:

- Inactivity fees

- Check fees

- Interest on loans via margin (source)

Customer service is important so it is highly suggested that you actually call up the broker or brokerage firm and speak to them live. It is easy to fill in online forms but this is the broker you may be depositing money with. Due diligence is extremely important.

Trading Order Mechanics

Deciding on a broker is personal however try to get one that has fast routing of your trading orders. The mechanics behind your online trading order getting filled on the open market centers on the forces of supply and demand of the instrument. You need fast execution to take advantage of any inefficiency you are exploiting so you don’t suffer from undue slippage on a trade:

Slippage: The difference between your intended trading price and your filled price

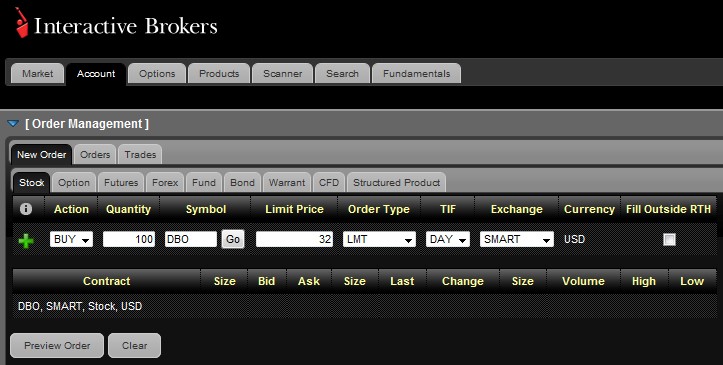

When you place your order to enter/exit a trade, you will use a platform such as this one from Interactive Brokers.

It is highly suggested that you spend ample time understanding the mechanics behind your trading platform so you enter exactly the information you intend and can do it with ease. When entering a trade, this is not time for uncertainty in your trading platform.

Important Order Information

In the graphic above, you can see various tabs covering Stocks to CFD’s. Let’s walk through a few of the labels so you understand what this order entry represents.

Action: This trader is place a buy order in a stock

Quantity: Since this is a stock example, the 100 equals 100 shares

Symbol: DBO is the ticker symbol for Power Shares DB Oil Fund Stock

Limit Price: The price this trader wants to execute at

Order Type: Limit order represents a resting order below current price where the trade would like to be filled.

TIF: This trader will let this order sit until the end of the trading day.

Online Trading Orders

You must be familiar with the types of entry orders available to you as a trader. There are pitfalls to be aware of with each of them.

- Market order. This is an instruction for your broker to get you into the trade “at the market” which means market price. Be aware that in highly volatile markets and times, you can encounter high slippage in the price you are filled at.

- Limit orders can either be a sell limit or buy limit. In a buy limit, price is currently above your desired price and the limit order sits waiting to be filled. A sell limit has current price below the desired price. The main drawback of limit orders is price may miss your desired price by a small margin and then turn into the biggest trend of the year.

- Stop orders sit like limits but when executed, they execute “at the market” which means slippage can occur. If you wanted to buy a breakout long, you would place a buy stop order above the breakout area. The order will sit waiting to be hit and then fill at the best possible price at that time.

The mechanics of online trading are not very complicated. You set up with a broker, deposit some money, and learn how to enter/exit trades on the platform. One thing however that is not talked about much is because your trading is online, what would you do if there were a power or internet outage?

Cover your bases and ensure that you have a backup plan if things go wrong.

Power outage? Your laptop has battery power so you can quickly manage the trade.

Internet outage? Use your smartphone tethered as an internet source using the provider’s network.

Computer failure? Use your landline or smartphone to contact your broker and close your positions